At The Konese, we believe free online tools should be fast and easy to use — without being buried under pop-ups, logins, or ads.

That’s why we built our own set of free tools — tools we actually use ourselves.

From checking your BMI to calculating your mortgage payments, here’s a quick tour of the 10 helpful free online tools available right now at tools.thekonese.com. Bookmark them, share them, or just explore what fits your needs.

🧘 Fitness & Health Tools

1. BMI Calculator

📏 Calculate your Body Mass Index to check if you fall within a healthy weight range.

The BMI calculator helps you quickly find out if your weight is healthy for your height. It’s a useful starting point if you want to set fitness goals or just keep track of your health. Simply enter your weight and height, and you get your BMI score immediately, along with a simple explanation of what that number means.

🔗 [Link to BMI Calculator]

2. Calorie Burn Calculator

🔥 Find out how many calories you burn during various activities — from walking to intense workouts.

Knowing how many calories you burn can help you plan your exercise and diet better. This calculator covers a range of activities, whether you’re walking your dog or doing a high-energy workout. Just enter the activity and time spent, and it will estimate your calorie burn. It’s a handy tool if you want to stay active without guessing your progress.

🔗 [Link to Calorie Burn Calculator]

🛒 Affiliate opportunity:

💡 “Looking for a simple fitness tracker? Check out this affordable fitness band on Amazon.

Note: If you purchase through this link, I earn a small commission at no extra cost to you.”

💰 Finance & Life Planning Tools

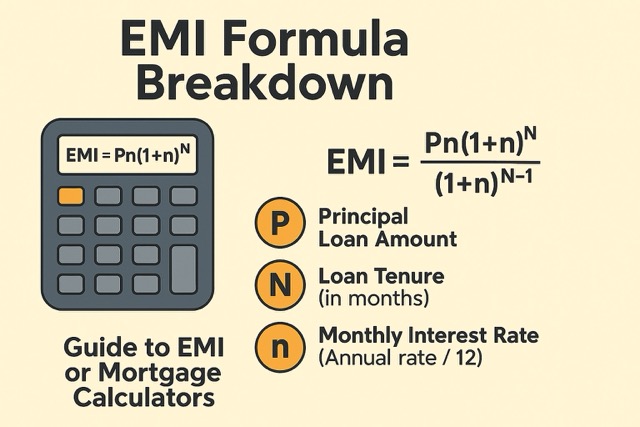

3. Mortgage Calculator

🏠 Buying a home is exciting but can be confusing. One of the biggest questions is: what will my monthly payments look like? Our mortgage calculator makes this easy to figure out.

Here’s how to use it:

- Enter Purchase Price (£): Type the price of the home you want to buy. For example, 300000.

- Enter Deposit: This is your upfront payment towards the home. You can enter it either as a flat amount or a percentage.

- Deposit Type: Choose whether your deposit is a flat amount (£) or a percentage of the purchase price. This helps the calculator understand your actual loan amount.

- Select Loan Term (years): Pick how many years you plan to pay off the mortgage — common terms are 10, 15, or 30 years, but you can choose what fits your plans.

- Enter Interest Rate (APR %): Add your mortgage’s interest rate. This affects how much you’ll pay each month beyond just the loan amount.

After you fill in these details, just click Calculate. You’ll get an estimate of your monthly mortgage payment, which helps you plan your budget realistically.

Why is this useful? Because knowing your payments upfront means fewer surprises later. You can also try different numbers to see how increasing your deposit or changing your loan term impacts your payments. This kind of insight helps you make smarter decisions before you sign on the dotted line.

🔗 [Link to Mortgage Calculator]

4. Loan Payment Calculator

💸 Loans come in all shapes and sizes — car loans, personal loans, student loans, and more. This calculator breaks down your payments so you can understand how much goes toward interest and how much reduces your loan balance.

It’s especially helpful if you’re thinking about paying off your loan early or refinancing. By playing with the numbers, you can see how extra payments or lower interest rates save you money over time.

🔗 [Link to Loan Payment Calculator]

🧮 Everyday Tools

5. Basic Calculator

Need quick math done without ads or distractions? Our basic calculator is simple and reliable. Use it for adding, subtracting, multiplying, or dividing anytime you need.

6. Age Calculator

🎂 Ever wondered exactly how old you are in years, months, and days? This tool calculates your precise age — perfect for birthdays, anniversaries, or just satisfying curiosity.

7. Date Difference Calculator

📅 Planning a trip, event, or project deadline? This calculator shows the number of days between two dates. It’s an easy way to count down or plan ahead without manually figuring it out.

🔗 [Link to Date Diff Calculator]

8. Temperature Converter

🌡️ Convert temperatures between Celsius, Fahrenheit, and Kelvin easily. Whether you’re cooking a recipe from another country or checking the weather forecast, this converter gives you the right number without headaches.

🤖 Smart & Specialized Tools

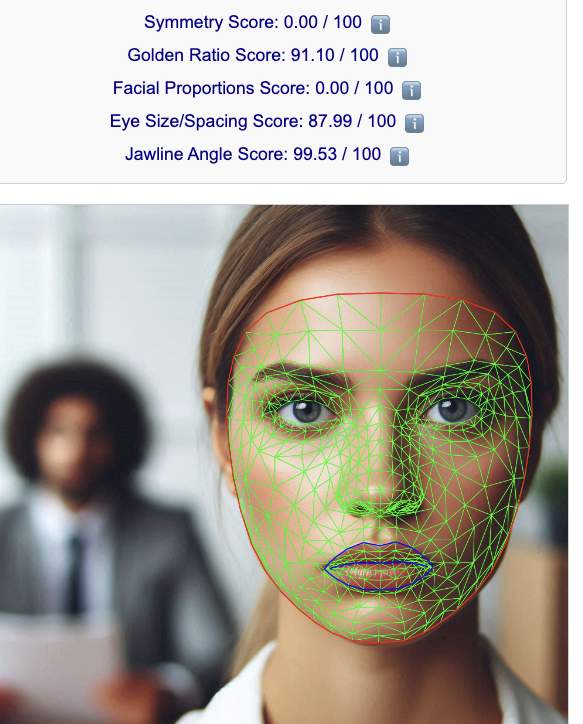

9. Face Analyzer (AI Tool)

📸 Upload a photo and our AI quickly analyses facial symmetry, golden ratio, and more!. It’s private and runs completely in your browser — so your photo never leaves your device.

It’s a fun way to experiment with AI tech, and you can try it with friends or family. Just keep in mind it’s for entertainment, not official analysis.

🛒 Affiliate suggestion:

“Want better lighting for your selfies or Zoom calls? Try this Amazon ring light — works great with AI tools like ours.

Note: If you purchase through this link, I earn a small commission at no extra cost to you.”

10. UK ILR Eligibility Checker

🇬🇧 If you’re on a UK visa, checking if you qualify for Indefinite Leave to Remain can be tricky. This tool makes it fast and easy. Just answer a few simple questions and get an instant idea of your eligibility.

It’s a must-have for anyone navigating UK immigration and wanting clarity without wading through confusing government sites.

🧩 Why these free online tools?

We built these tools because we were tired of bloated, ad-heavy sites that make simple tasks harder than they need to be.

Everything at The Konese is:

- ✨ Free to use

- 🧼 Clean and minimal

- 📱 Mobile-optimized

- 🔐 No sign-ups required

We’re always working on improving our current tools and adding new ones based on your feedback. Your suggestions shape what we build next.

🙌 Try Them, Share Them, Support Us

We hope you find these tools useful. Please share this post with friends who might like them. Bookmark the ones you use often. Send us your feedback or ideas for new tools.

If you want to support us, check out the gear we recommend through our Amazon links. If you buy through these links, we earn a small commission at no extra cost to you. This helps us keep everything free and improve the tools over time.

Let’s keep the internet simple, helpful, and friendly — together.