Affiliate Disclosure: Some links in this post may be affiliate links. If you make a purchase through them, I may earn a small commission at no extra cost to you. This helps support this blog and keeps it running.

How to calculate your loan EMI?

If you’ve ever taken a loan – or are planning to – you’ve likely heard of EMI. But what exactly is EMI? And why do so many people rely on EMI calculators before committing to a loan? Let’s break it down in simple terms and show you how using a digital EMI calculator can save you from nasty surprises down the road.

💡 What is EMI?

EMI stands for Equated Monthly Installment. It’s the amount you pay every month to your bank or financial institution until your loan is fully repaid. Your EMI includes both the principal (the actual loan amount) and the interest (the cost of borrowing the money).

The two main factors that influence EMI are:

- Loan amount – How much you’re borrowing

- Interest rate – What the lender charges you

- Tenure – The time over which you repay the loan

Example: Borrowing ₹5,00,000 at 10% annual interest for 5 years? Your EMI will be around ₹10,624/month. A small change in tenure or rate can make a big difference.

🎯 Why Use an EMI Calculator?

You could do the math yourself, sure – but why waste time? A good EMI calculator does the hard work instantly. It’s especially helpful when you’re comparing multiple loan offers, tweaking terms, or just trying to see what fits your budget best.

Here’s what an EMI calculator helps with:

- Fast results: No manual formulas needed

- Scenario planning: Test different tenures and interest rates

- Avoid surprises: Know exactly what you’ll pay each month

📌 Recommended Tool: Try our Free EMI Calculator – no signups, no hassle.

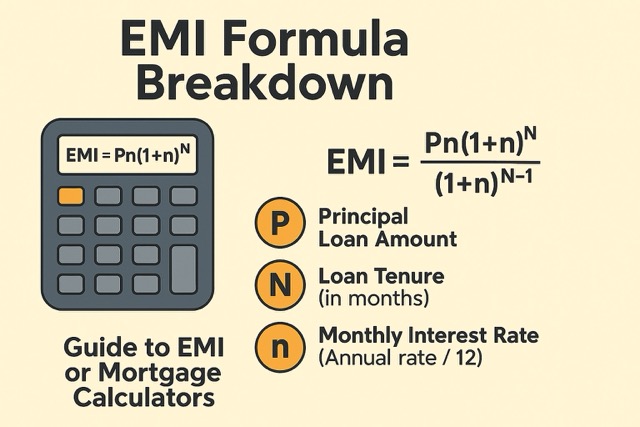

🧮 How Does an EMI Calculator Work?

It uses a standard formula:

EMI = [P x R x (1+R)^N] / [(1+R)^N – 1]

Where:

- P = Principal loan amount

- R = Monthly interest rate (annual rate ÷ 12 ÷ 100)

- N = Loan tenure in months

This may look complicated, but behind the scenes, a calculator crunches it in milliseconds. You just enter the 3 basic inputs: loan amount, interest rate, and duration.

💸 What Can You Use It For?

An EMI calculator isn’t just for home loans. You can use it for:

- Personal Loans

- Car Loans

- Home Loans

- Business Loans

- Education Loans

- Buy Now Pay Later (BNPL) schemes

The flexibility makes it a smart habit to check your EMI before any financial commitment.

🔗 Need a loan? First, check your EMI using our free calculator tool here.

✅ Benefits of Using an Online EMI Calculator

- No guesswork – You see the exact monthly payout

- Compare offers easily – Try different interest rates from lenders

- Save time – Get answers instantly, without paperwork

- Plan your finances – See if a loan fits your monthly budget

[Also Read: Why Online Calculators Save Time & Money]

⚠️ Things to Keep in Mind

Remember, the calculator gives you a close estimate – not always the exact amount you’ll pay. Some banks may add additional fees (processing, insurance, etc.) that change the final EMI slightly.

Still, it’s a powerful planning tool. Know your limits, test different scenarios, and avoid financial overreach.

Pro Tip: Always leave a buffer in your budget beyond just the EMI. Emergencies happen.

📌 Final Thoughts

An EMI calculator isn’t just a tool—it’s peace of mind. Whether you’re a first-time borrower or a seasoned financial planner, it’s your best friend before making a big decision. It empowers you to borrow smart, not blindly.

Start using one regularly, and you’ll never go back to the “hope it works out” method of money management again.

Try the free EMI calculator on TheKonese.com and take control of your loan journey today!

Affiliate Disclosure: Some links in this post may be affiliate links. If you make a purchase through them, I may earn a small commission at no extra cost to you. This helps support this blog and keeps it running. 🙌

Leave a Reply